What does the UK’s post-election turmoil mean for the sovereign professional? Here are a few thoughts.

Greater and prolonged uncertainty

Uncertainty is never a good thing for business. For the sovereign professional, it will likely mean clients with tighter budgets and slower buying cycles. The risk is an increase in your days un-billed.

A more business-friendly government?

With various media reports suggesting the Chancellor Philip Hammond now exerting greater influence, we may see more attention paid to the impact upon, and the needs of, business … which, after all employs people, sells goods and generates one way or another almost all the tax paid to government.

We should also anticipate an end to those nauseating “citizens of nowhere” speeches.

In fact, today’s Times anticipates a much more pro-business Mansion House speech, this evening:

In his annual address to City leaders at Mansion House today, Mr Hammond will say: “Investors need certainty in order to continue to support the UK economy and create jobs as we leave the EU.

“That is why we will fortify the vital financial support that helps businesses to grow — from cutting-edge start-ups right through to large-scale infrastructure projects.”

A softer Brexit?

Democracy is a blunt instrument. There is plenty of speculation that the election result was a vote for turning away from the stated path of Hard Brexit. That’s not at all clear, however.

Was the unexpected surge in Labour’s vote really a vote against Hard Brexit? Both Labour and the Conservative party had stated goals of leaving both the European Union and the Single Market. The Single Market is generally held as a border between hard and soft. By contrast, the only party that actively promoted a different, softer approach – the Lib Dems – failed to recover from the distinct kicking they got in 2015. Leader Tim Farron announced his resignation last night.

Was the Youth Vote for Labour a vote for Soft Brexit? Or, more likely, was it a positive response to the party’s promised bribes of cancelling university fees?

Interestingly, the BBC reports that while there was a marked increase in graduates voting for Labour, there was also an increase in less-well-educated voters (those with only a GCSE exams, generally taken at 16) voting Conservative, and against Labour’s tradition of supporting the working class. Was this the post-UKIP vote calling for a hard line on immigration and, therefore, for a Hard Brexit?

I can’t see any clear sign in all of this that there was any true call for a softer approach. Daniel Finkelstein outlines the challenge is his column in yesterday’s Times:

Extraordinarily we have produced a parliament that, when it comes to the terms on which we leave the EU, has no majority for anything. Or for its opposite. The moment you depart from those vague and useless terms “hard Brexit” (boo) and “soft Brexit” (hooray), you are left with nothing.

I doubt there is a majority for staying in the single market, or for departing. And you might think that logic dictates that there literally had to be a majority for one of the three options of leaving without a deal, approving a deal or not leaving at all, but no. I really don’t believe that there is.

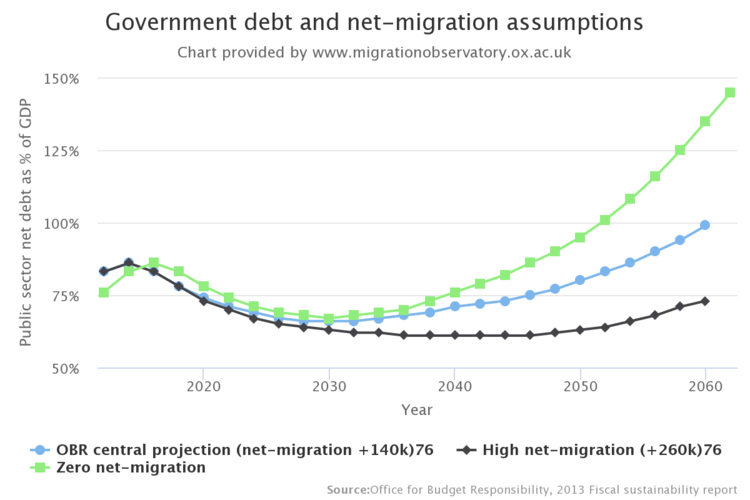

It is, however, fairly certain that MPs themselves, the overwhelming majority of whom supported remaining in the EU, would favour a softer approach that kept the country’s access to valuable markets and skills. We desperately need more not less immigration. Our high tech businesses need talent and our greying population needs healthcare workers. Our farmers need fruit pickers and, vitally, our coffee shops need baristas.

But opportunity, too

Turmoil and uncertainty breed innovation and opportunity. If your business is supplying short-term, B2B services (as an interim manager perhaps, or a consultant) then you can offer an on-demand service free from long-term commitment. You can help clients deliver on their existing strategy, while they consider how to respond to a changing environment. Or, you can offer fresh, objective, real-world experience to help shape their thinking.

Stress and uncertainty, but opportunity too. Carpe Diem.

Image credit: https://unsplash.com/@dvancea